Estimates Range From Days To Weeks To Re-Open Suez Canal

The Suez Canal, connecting the Mediterranean and Red Seas, is the most direct east / west passage connecting Europe to the Indian subcontinent and Asia. 12% of the world’s global trade by volume passes through the Suez annually including containerships, oil, LNG, bulk carriers and other commercial and passenger traffic. Daily global container volume is a full thirty percent.

The Suez Canal, connecting the Mediterranean and Red Seas, is the most direct east / west passage connecting Europe to the Indian subcontinent and Asia. 12% of the world’s global trade by volume passes through the Suez annually including containerships, oil, LNG, bulk carriers and other commercial and passenger traffic. Daily global container volume is a full thirty percent.

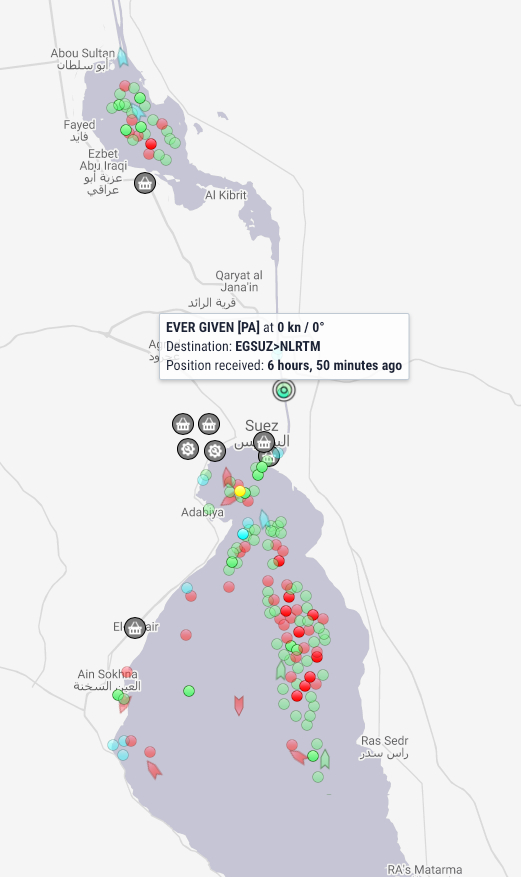

En route from China to Rotterdam, the Ever Given had begun traveling northbound and was approximately 4 miles from the southern entry point when it became grounded. Investigators have not yet determined a cause, but initial reports point to high winds blowing the vessel off course.

The Canal Authority is working with local and international experts to loosen the ship. Attempts have been made to dislodge the vessel throughout the week, including hopes that tugs could move her during a high tide on Thursday. That proved unsuccessful, and professional salvors are onsite evaluating what options are available. If they cannot free her in her current condition then it is likely that weight will have to be removed from the 224,000 ton vessel to float her higher in the water. This would involve removing containers, ballast water and fuel oil, further complicating and delaying attempts to reopen the shipping lane.

For commercial ships trapped on either side of the passage, calculations are being made as to whether or not to wait out the work or commit to navigating south around the Cape of Good Hope, adding 3,800 miles and up to 12 days additional transit time and for ships like oil tankers, an extra $300,000 in fuel costs.

Maersk and Hapag Lloyd are considering the African reroute option, while MSC and CMA-CGM have said at this time they are not contemplating diversions but will remain in contact with their customers.

The carryover effect for US trade is threefold.

- These late arrivals and departures are going to impact ports like Hamburg who have had to restrict container pickups and deliveries to narrow windows of time. The delays caused by this will mean more containers kept offsite, possibly incurring demurrage or detention costs until they can be returned on a schedule demanded by the lines and terminals.

- The delay of import deliveries by not just the Ever Given but other ships trapped behind her means another hiccup in the availability of boxes to load for exports to markets like the United States.

- Finally, after having to accept hundreds of blanked sailings and schedule hiccups throughout 2020, shippers are likely to be the victims of additional delays and in the worst cases, unscheduled blanked sailings as lines skip port calls to get vessels in pendulum and fixed-day services back on track.

We understand that this is one more unforeseen delay that further wrinkles supply chains, especially immediately prior to the four day European Easter holiday weekend next week. It is our commitment to continue to monitor efforts to reopen the Suez, including what it means for global containership schedules and will advise our customers accordingly.

WE’RE HERE TO HELP

Our capable and experienced team is standing by to assist organizations and supply chains across the globe. Click the button to get in touch with our team.